Best Hints For Picking RSI Divergence Trading

Wiki Article

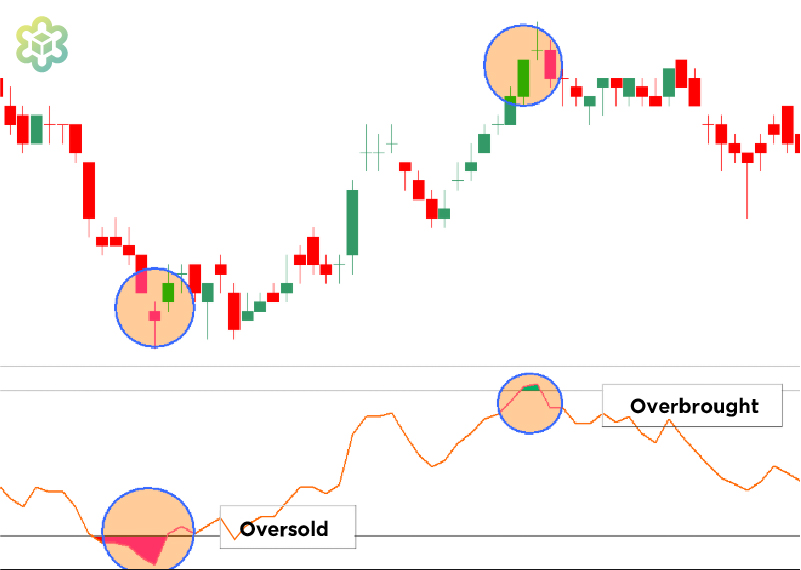

Okay, let's begin by asking the obvious question and find out what RSI Divergence is and what trading indicators we can learn from it.|Okay, let's start with the most obvious question. Let's look into what RSI Divergence means and what trading indicators it might give.|Let's begin with the obvious question. We will explore the meaning of RSI Divergence actually is and what trading insights we can derive from it.|Ok, let's start by asking the most obvious question. Let's look at what RSI Divergence really is and the trading signals we can learn from it.|Let's begin by asking the obvious question. Let's explore what RSI Divergence looks like and what trading clues can be gleaned from it.} If your price action and RSI indicator are not in sync on the chart, then there is an underlying divergence. In an economy that is in a downtrend where the price action creates lower lows, and the RSI indicator is able to make lower lows. In other words, divergence can be observed when the indicator does not accept the price action. If this happens you must be aware. Based on the chart, both bullish RSI divergence and the bearish RSI divergence are clear and the price movement has actually reversed in the wake of both RSI Divergence signals, isn't it? Let's move on to the fun discussion. Take a look at most popular crypto trading bot for blog recommendations including divergence trading forex, forex backtesting software, forex backtest software, crypto trading backtester, crypto trading, backtester, position sizing calculator, software for automated trading, crypto trading, divergence trading and more.

How Do You Analyze The Rsi Divergence

We utilize the RSI indicator to be able to recognize trends that have reversals. However, it is crucial to recognize the most appropriate trend reverse.

How Do You Spot Rsi Divergence When Trading Forex

At the beginning of the uptrend at the beginning of the uptrend, both RSI indicator and Price Action did the exact similar thing, forming higher highs. This means that the trend is strong. When the trend is over, trend, price forms higher highs and the RSI indicator makes lower highs. This indicates that there are some things worth monitoring in this chart. This is the reason we have be aware of the market. The indicator and the price movement are not on the same page and could be a sign of an RSI Divergence. In this instance, the RSI divergence is a sign of bearish trend rotation. Look up at the chart to observe the changes that happened after the RSI diversification. The RSI divergence is very precise in identifying trends reverses. Now, the question is how to spot the trend reverse. Let's examine four trade entry strategies that can be used in conjunction with RSI Divergence to provide more reliable entry signals. See the top trading platform crypto for site recommendations including crypto backtesting, trading platform, crypto backtesting, automated forex trading, software for automated trading, stop loss, backtesting platform, software for automated trading, stop loss, cryptocurrency trading and more.

Tip #1 – Combining RSI Divergence & Triangle Pattern

Triangle chart pattern is available in two variations, One is The ascending triangle pattern, which can be used as a reversal design in the downtrend. The pattern of the descending triangle can be employed to reverse the trend of a market in an uptrend. Now, Have an examination of the descending triangle pattern marked in the chart below for forex. Like the previous example above it was in an uptrend , before the price dropped. RSI also indicates divergence. These signals reveal the flaws in this trend. The current price shows that the momentum of the ongoing uptrend has waned and that the price was capped in a triangular pattern that descending. This confirms the reversal. It is now time to start short trading. This trade was made using the same breakout methods as the previous one. We'll now look at the third method of trading entry. This time, we'll combine trend structure with RSI diversgence. Let's look at the best way to trade RSI divergence when the trend structure shifts. Follow the recommended trading platform for website info including best trading platform, forex backtester, automated forex trading, forex backtesting, divergence trading, forex backtesting software, forex backtesting software, crypto backtesting, trading platform cryptocurrency, backtester and more.

Tip #2 – Combining RSI Diversity with the Head &shoulders Pattern

RSI divergence assists forex traders in recognizing market reversals. Combining RSI divergence with other reversal indicators like the head and shoulders pattern will increase the probability of trading. This is great! Let's look at how we can make sure we time our trades by using RSI divergence and the pattern of the Head and Shoulders. Related: How to Trade Head and Shoulders in Forex - A Reversal Trading strategy. A favorable market environment is required before we consider the entry of trades. Trending markets are preferred because we're trying to identify an indicator of a trend reversal. See the chart below. Check out the top crypto trading bot for more info including cryptocurrency trading, cryptocurrency trading, forex backtest software, RSI divergence, software for automated trading, divergence trading forex, position sizing calculator, best forex trading platform, trading divergences, automated trading platform and more.

Tip #3 – Combining RSI Divergence and the Trend Structure

Trends are our friend. If the market is trending, we need to invest according to the direction of the trend. This is the way professionals train us. However, the trend isn't lasting forever. At the point where it will begin to reverse, isn't it? Let's look at the structure of the trend, RSI Divergence and how to recognize Reversals. We are all aware that the trend is making higher highs, whereas the downtrend is making lower lows. The chart below illustrates this point. On the left hand side of the chart , you'll see a downtrend. There are several of lows, followed by lower highs. Take a closer look at the RSI divergence marked on the chart (Red Line). The price action is what creates lows, however the RSI produces lower lows. What is this implying? Even though the market creates low RSI is the reverse. This indicates that the downtrend that is currently in place has lost momentum. It is important to be prepared for a reversal. Read the top best crypto trading platform for blog tips including best forex trading platform, trading with divergence, forex backtesting software free, bot for crypto trading, best trading platform, crypto trading backtesting, backtesting, forex tester, crypto trading backtester, software for automated trading and more.

Tip #4 – Combining Rsi Divergence And The Double Top/Double Bottom

Double-bottom is a reversal chart that forms after a long move or a trend. In the double top, the first top will be formed when the price is at the level at which it cannot be broken. Once that level has been reached, the price will drop a bit, but then rebound back to test the previous level. If the price bounces again from that mark, you'll have the option of a DOUBLE. Below is a double top. The double top shows double top that both tops were created following a powerful move. It is evident that the second top was not able to break above the one. This is a sign of an inverse. It is telling buyers that they have a hard time moving higher. The same principle applies to the double bottom as well however, in the opposite direction. In this case, we'll use the method of entry using breakouts. We execute a sell trade when the price falls below the trigger level. We took our profit once the price was below the trigger line. Quick Profit. Double bottom is covered by the same trading strategies. The chart below shows the best way to trade RSI Divergence when trading Double Bottom.

Be aware that this strategy is not perfect. There is no "perfect" trading strategy. Every trading strategy suffers from losses. Profits are consistent through this strategy, however we have a strict risk management and a method to reduce our losses rapidly. This will enable us to cut down on drawdowns, and open the door to huge upside possibilities.